GENERAL INFO AND BENEFITS

If you have been hurt in a car accident in Canada and have an insurance policy underwritten in Ontario, generally speaking there are two parts to a claim if you are not at fault. In simple terms, you claim benefits from your own insurance company, which are called ‘Accident Benefits’ (AB benefits) and you can sue the at-fault party, that was responsible for causing the accident and in legal terms is referred to as the ‘Tort Claim’.

The AB claim begins right away by submitting an OCF-1 (Application for Accident Benefits) to the insurer upon being involved in an accident. There are benefits you are entitled to from your own insurer, such as medical rehabilitation, attendant care, income replacement benefits etc. In the tort claim, you seek damages for pain and suffering, income loss, economic loss, future cost of care etc. from the insurer of the at fault driver/operator.

Note that the tort claim is not usually commenced forthwith subsequent to the accident. There is a 2 year limitation period and a claim must be commenced within 2 years from the date of the accident. At our firm, we commence your tort claim contingent upon your injuries sustained and your level of recovery. We further take into consideration how permanent your injuries are and if your life has changed forever. Every case is unique and has its own merits.

There is a common misunderstanding amongst the general public that you are entitled to compensation just because you were hit or hurt in a car accident. You must appreciate that you will not be entitled to compensation just because you were hit in an accident. You must have sustained some sort of loss or injury that prevents you from functioning in the same way you did prior to the accident. The insurance company for the at-fault driver, will thoroughly assess your damages and evidence prior to being agreeable to making any payment to you or even discuss settlement of your claim. You should also be aware that your claim for damages is limited to the policy limits purchased by the at-fault driver. For example, the at-fault driver, in your instance, may have purchased policy limits up to $2,000,000 (million), therefore, your damages would be capped at this amount with the at-fault party’s insurance company. However, if your injuries are worth more than this amount, then the driver and/or owner of the at-fault party, would be liable for the additional amount above the policy limits.

The next question that may now cross your mind is, where do I obtain evidence from to prove that I am hurt? Well the answer to that question is quite simple. If you are genuinely hurt, you will visit your family doctor regularly, if your injury or injuries have exacerbated, then your treating doctor will refer you to specialists and if you are unable to return to work or work as much as you did before, then such information can always be verified from your medical record, employment records, tax returns etc.

To learn of what benefits you are entitled to from your own insurance company, click "At-Fault, What are my benefits? - Accident Benefits"

To learn of what categories under which you can seek damages from the at-fault party, click "I was not at fault – what are my rights?"

“AT-FAULT, WHAT ARE MY BENEFITS? – Accident Benefits (AB)”

If you were involved in a car accident prior to June 1, 2016, you are then entitled to the following benefits from your own insurance company, regardless of whether you were at fault or not:

Medical Rehabilitation – chiropractic, psychological, occupational therapy and physiotherapy services; medication; prescription eyewear; dentures and other dental devices; hearing aids, wheelchairs or other mobility devices, prosthesis, orthotics or other assistive devices;

- $3,500 – Minor Injury Guideline (MIG)

- $50,000 – Non-Catastrophic

- $1,000,000 – Catastrophic

- If Non-Catastrophic, you are eligible for treatment for the next 10 years from the date of the accident

- If deemed Catastrophic, benefits are lifetime until depleted

Income Replacement Benefit (IRB) – If you are substantially unable to do the tasks of your own employment

- Not payable for the first 7 days

- 70% of Weekly Income capped at $400 per week

- Eligible for this benefit if for the first 2 years, you are unable to do tasks of your own employment

- Eligible for this benefit after 2 year mark if unable to do any kind of employment or self-employment for which you may reasonably be suited by education, training or experience

- Can take up to 1 month to begin as insurance requires various documents, in particular if you are self-employed or run your own business.

Attendant Care> – help with personal tasks, for example, bathing, showering, feeding, cutting toe nails etc.

- $3,000 per month if Non-Catastrophic

- Maximum entitlement is $36,000

- $1,000,000 – Catastrophic

- $6,000 per month at maximum if deemed Catastrophic

Non- Earner Benefit – complete inability to carry on a normal life

- Six month waiting period

- If eligible, then entitlement is $185 per week

Housekeeping

- If deemed Catastrophic - $100 per week

However due to legislative changes brought by the provincial government in power in 2016, benefits were almost reduced to half of what were earlier offered and therefore, if you were involved in a car accident after June 1, 2016, you are then entitled to the following benefits from your own insurance company, regardless of whether you were at fault or not:

Medical Rehabilitation - chiropractic, psychological, occupational therapy and physiotherapy services; medication; prescription eyewear; dentures and other dental devices; hearing aids, wheelchairs or other mobility devices, prosthesis, orthotics or other assistive devices;

- $3,500 – Minor Injury Guideline (MIG)

- $65,000 combined with Attendant Care – Non Catastrophic

- $1,000,000 combined with Attendant Care – Catastrophic

- If Non-Catastrophic, you are eligible for treatment for the next 5 years from the date of the accident

Income Replacement Benefit (IRB) – If you are substantially unable to do the tasks of your own employment

- Not payable for the first 7 days

- 70% of Weekly Income capped at $400 per week

- Eligible for this benefit if for the first 2 years, you are unable to do tasks of your own employment

- Eligible for this benefit after 2 year mark if unable to do any kind of employment or self-employment for which you may reasonably be suited by education, training or experience

- Can take up to 1 month to begin as insurance requires various documents, in particular if you are self-employed or run your own business.

Attendant Care – help with personal tasks, for example, bathing, showering, feeding etc.

- $3,000 per month if Non-Catastrophic

- Maximum entitlement is $65,000 combined with Medical Rehabilitation

- $1,000,000 combined with Medical Rehabilitation – Catastrophic

- If Non-Catastrophic, you are eligible for treatment for the next 5 years from the date of the accident

Non- Earner – complete inability to carry on a normal life

- 4 weeks waiting period

- If eligible, then entitlement is $185 per week to a maximum of 2 years

Housekeeping

- If deemed Catastrophic - $100 per week

“I WAS NOT AT FAULT FOR THE ACCIDENT – WHAT ARE MY BENEFITS?”

- If you were involved in a ‘not at fault’ accident, then not only are you entitled to ‘Accident Benefits’ (AB) from your own insurer, which are noted above, but you will be able to sue the at-fault driver in Small Claims court, Rule 76 Simplified Procedure or in the Superior Court of Justice ordinary procedure, depending on what the damages you sustained may be worth.

- It is imperative that you speak to your lawyer about ensuring that the value of your claim is assessed appropriately. If you sue in the wrong jurisdiction and despite being successful, you may be liable for the costs of the defendant. Damages for claims worth in the range of $500 to $25,000 should be commenced in Small Claims Court. Claims worth in the range of $25,001 to $100,000 should be commenced in the Superior Court of Justice under Rule 76 – Simplified Procedure of the Rules of Civil Procedure. Claims worth above $100,000 are commenced in the Ontario Superior Court of Justice under ordinary procedure. Further, claims should be commenced in the region where the accident occurred.

- Note that the tort claim is not usually commenced forthwith subsequent to the accident. There is a 2 year limitation period and a claim must be commenced within 2 years from the date of the accident. At our firm, we commence your tort claim contingent upon your injuries sustained and your level of recovery. We further take into consideration how permanent your injuries are and if your life has changed forever. Every case is unique and has its own merits.

- There is a common misunderstanding amongst the general public that you are entitled to compensation just because you were hit or hurt in a car accident. You must appreciate that you will not be entitled to compensation just because you were hit in an accident. You must have sustained some sort of loss or injury that prevents you from functioning in the same way you did prior to the accident. The insurance company for the at-fault driver, will thoroughly assess your damages and evidence prior to being agreeable to making any payment to you or even discuss settlement of your claim. You should also be aware that your claim for damages is limited to the policy limits purchased by the at-fault driver. For example, the at-fault driver, in your instance, may have purchased policy limits up to $2,000,000 (million), therefore, your damages would be capped at this amount with the at-fault party’s insurance company. However, if your injuries are worth more than this amount, then the driver and/or owner of the at-fault party, would be liable for the additional amount above the policy limits.

- The next question that may now cross your mind is, where do I obtain evidence from to prove that I am hurt? Well the answer to that question is quite simple. If you are genuinely hurt, you will visit your family doctor regularly, if your injury or injuries have exacerbated, then your treating doctor will refer you to specialists and if you are unable to return to work or work as much as you did before, then such information can always be verified from your medical record, employment records, tax returns etc.

Below are the various heads of damages, under which you can make a claim against the at-fault driver and owner:

Pain and Suffering

- Threshold Test: In order for the plaintiff to meet the threshold test, he or she must have suffered a permanent serious disfigurement or a permanent serious impairment of an important physical, mental, or psychological function in accordance with sections 267.5 of the Insurance Act.

- The maximum anyone can receive in Ontario for pain and suffering is $350,000 and to be entitled to this amount, your injuries must meet the definition of being a paraplegic or quadriplegic.

- If damages are assessed at less than $124,616.21, then a deductible in the amount of $37,385.17 is applicable. In simple words, the insurer is entitled to a discount in this amount and you may be wondering why! However, it is the law and there is nothing we can do about it unless the provisions of the Insurance Act are amended by the legislature.

Income Loss

- You are entitled to 70% of your lost income as a result of the accident, pursuant to the Insurance Act before trial and 80% after trial that is, if your matter proceeds to trial and does not settle beforehand.

- Do keep in mind that if you have received Income Replacement Benefits from your own insurance company, which is your Accident Benefits carrier, then you cannot double dip.

Loss of Competitive Advantage or Economic Loss

- It is under this head of damages that you will seek damages for future loss of income, loss off opportunity etc.

- For example, prior to the accident, you may have done overtime work, which you can no longer do because of the accident, or you may not be able to work at the same capacity as you did prior to the accident. You can be entitled to significant damages.

- You may have had a job opportunity come your way, which you were unable to accept as a result of your injuries from the accident

- You may have been enrolled in school, college or university at the time of the accident and have now fallen behind by a few months, year or even a few years.

Housekeeping

- You can hire a friend, family member, relative or professional to assist in housekeeping tasks.

- It is not imperative that you pay at the time services are acquired

- This person can be paid at the time of settlement

- Gather all invoices and store them in a box and provide them to your lawyer

- It is always best to seek the services of a professional

Future Cost of Care

- The injuries you sustained in the accident, may require you to seek medical and rehabilitation benefits not covered by OHIP for the remainder of your life

- You are entitled to medical / rehabilitation benefits from your Accident Benefits carrier in the amount of $65,000 for 5 years from the date of your accident; that is if your injuries fall outside the Minor Injury Guideline (MIG).

- It may be likely that this amount from your Accident Benefits carrier may not be sufficient to pay for your medical and rehabilitation benefits and therefore you may seek damages from the at fault party for your damages in excess of this amount.

- There is case law that unequivocally speaks to the fact you can settle your accident benefits claim prior to the tort claim, if you are being offered a reasonable settlement by your Accident Benefits insurer.

Loss of Caregiving Ability

- Prior to the accident, you may have young children or elderly parents you were responsible for taking care of.

- Unfortunately, the accident has now left you in a position as a result of the injuries you sustained, where you are unable to provide care to a loved one

- If you are now required to hire someone or seek the services of a professional to assist or perform caregiving activities that you did prior to the accident, then you may then be eligible to seek damages under this category.

- Always remember that you require evidence to substantiate such claims. Just because you say it, does not mean that an insurance company will simply cut you a cheque. You must keep track of all invoices, bank drafts or cheques, dates of attendances, type of assistance provided etc. to make such claims.

- We highly recommend you make notes to keep track of all entries with the date, time and activity performed with the name and contact information of the person from whom you sought such services.

“PASSENGER IN SOMEONE’S VEHICLE”

- If you were a passenger in someone’s vehicle and hurt in a car accident, you can always make a claim. The first question that a lawyer will ask you is whether you have an auto insurance policy under your personal name or whether you are listed as a second or third driver under an auto insurance policy in Ontario.

- If you are a passenger in someone’s car that was involved in an accident, for example a colleague, co-worker, friend etc. and you have your own auto insurance policy, then you will have to make a claim for Accident Benefits with your own auto insurer, it is exactly why you pay monthly premiums for auto insurance. If you have your own insurance, then you cannot make a claim for Accident Benefits under the policy of the vehicle that was being driven at the time of the accident. To be clear, even though you were not driving or traveling in your own vehicle and you are a passenger in someone’s vehicle, you are still required by law to make a claim for Accident Benefits with your own insurance company.

- If you are passenger in someone’s care that was involved in an accident and you are not listed as a driver under an auto policy in Ontario, then in such an event, you will be able to make a claim for Accident Benefits under the auto insurance policy of the vehicle that you were traveling in at the time of the accident. For further clarity, if you are being driven in a friend’s vehicle and are a passenger and this vehicle is involved in an accident and you do not have your own auto insurance, then you can make a claim for Accident Benefits under your friend’s auto insurance policy.

- As a passenger in another vehicle, you will most likely not be held responsible for the accident. Either the person driving the vehicle that you were traveling in would be liable for the accident and your injuries, or another third party vehicle that negligently or recklessly struck the vehicle that you were a passenger in will be held liable for your injuries. Therefore, you will be able to make an Accident Benefits and Tort claim.

- For the benefits you can claim against your own insurer, known as Accident Benefits, click this link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- To know what heads of damages you can claim compensation under against the at-fault driver or vehicle, click this link “I WAS NOT AT FAULT – WHAT ARE MY RIGHTS?”

PEDESTRIAN HIT – I DON’T HAVE AUTO INSURANCE

- Unlike routine motor vehicle accidents, where negligence has to be proved by the party making allegations of causing an injury, in pedestrian accidents, the onus is always upon the driver in accordance with s.193 of the Highway Traffic Act.

- To be clear, even if you think that you may have been at fault for an accident as a pedestrian, the onus is on the driver of the vehicle that struck you to prove that he or she took every reasonable step to avoid hitting you.

- So if you are a pedestrian and have been struck by a vehicle and you are not listed under an Auto Insurance policy in Ontario or do not have auto insurance, then you can make a claim for Accident Benefits on the policy of the operator/owner of the vehicle that struck you.

- If you have your own auto insurance policy, then you will make a claim for Accident Benefits from your own insurer to whom you have been paying monthly insurance premiums.

- For the tort claim, you will sue the same operator/owner of the vehicle that struck you.

- For the benefits you can claim against your own insurer, known as Accident Benefits, click this link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- To know what heads of damages you can claim compensation under against the at-fault driver or vehicle, click this link “I WAS NOT AT FAULT – WHAT ARE MY RIGHTS?”

BICYCLE HIT – I DON’T HAVE AUTO INSURANCE

- Unlike routine motor vehicle accidents, where negligence has to be proved by the party making allegations of causing an injury, in bicycle accidents, the onus is always upon the driver in accordance with s.193 of the Highway Traffic Act.

- To be clear, even if you think that you may have been at fault for an accident as a cyclist, the onus is on the driver of the vehicle that struck you to prove that he or she made every reasonable step to avoid hitting you.

- So if you are a cyclist and have been struck by a vehicle and you are not listed under an Auto Insurance policy in Ontario or do not have auto insurance, then you can make a claim for Accident Benefits on the policy of the operator/owner of the vehicle that struck you.

- If you have your own auto insurance policy, then you will make a claim for Accident Benefits from your own insurer to whom you have been paying monthly insurance premiums.

- For the tort claim, you will sue the same operator/owner of the vehicle that struck you.

- For the benefits you can claim against your own insurer, known as Accident Benefits, click this link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- To know what heads of damages you can claim compensation under against the at-fault driver or vehicle, click this link “I WAS NOT AT FAULT – WHAT ARE MY RIGHTS?”

WRONGFUL DEATH

- Ontario’s Family Law Act has set the rules for who can seek damages in a wrongful death lawsuit. The court assesses damages from a wrongful death lawsuit on the premise the amount of damages the deceased victim would have been entitled to, had he or she survived the injuries from the car accident.

- In accordance with Ontario law, the surviving spouse and other family members can collect damages. Other family members than can claim damages are:

- Surviving Spouse

- Children

- Parents

- Grandchildren

- Grandparents

- Siblings - A wrongful death lawsuit can be brought against the negligent party in order to recover the following types of potential damages.

- Funeral Expenses

- Dependants’ compensation for travel expenses when visiting the person during his or her treatment prior to death

- Compensation for a dependant(s) for loss income or shared family income;

- Damages for household services that would have been provided throughout the course of the marriage;

- Damages for the loss of companionship or loss of guidance to dependents - Call us now at 905 744 8888 or 519 891 8888 if you have lost a loved one in a motor vehicle accident. Our aggressive team of lawyers can assist you and obtain the best possible settlement for you and your family.

TAXI / UBER/ RIDE SHARE ACCIDENT

- If you were a passenger in a taxi / uber/ ride share vehicle and hurt in a car accident, you can always make a claim. The first question that a lawyer will ask you is whether you have an auto insurance policy under your personal name or whether you are listed as a second or third driver under an auto insurance policy in Ontario.

- If you are a passenger in a taxi / uber/ ride share vehicle that was involved in an accident and you have your own auto insurance policy, then you will have to make a claim for Accident Benefits with your own auto insurer, it is exactly why you pay monthly premiums for auto insurance. If you have your own insurance, then you cannot make a claim for Accident Benefits under the policy of the vehicle that was being driven at the time of the accident. To be clear, even though you were not driving or traveling in your own vehicle and you are a passenger in a taxi / uber/ ride share vehicle, you are still required by law to make a claim for Accident Benefits with your own insurance company.

- If you are passenger in a taxi / uber/ ride share vehicle that was involved in an accident and you are not listed as a driver under an auto policy in Ontario, then in such an event, you will be able to make a claim for Accident Benefits under the auto insurance policy of the vehicle that you were traveling in at the time of the accident. For further clarity, if you are being driven in a taxi / uber/ ride share vehicle and are a passenger and this vehicle is involved in an accident and you do not have your own auto insurance, then you can make a claim for Accident Benefits under the taxi / uber/ ride share vehicle auto insurance policy.

- As a passenger in a taxi / uber/ ride share vehicle, you will most likely not be held responsible for the accident. Either the person driving the vehicle that you were traveling in would be liable for the accident and your injuries, or another third party vehicle that negligently or recklessly struck the vehicle that you were a passenger in. Therefore, you will be able to make an Accident Benefits and Tort claim.

- For a detailed explanation of the benefits you can claim against your own insurer or the vehicle that you were traveling in (taxi /uber/ ride sharing vehicle), known as Accident Benefits, click the link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- To know what heads of damages you can claim compensation under against the at-fault driver or vehicle, click the link “I WAS NOT AT FAULT – WHAT ARE MY RIGHTS?”

HIT BY UNIDENTIFIED / UNINSURED VEHICLE

- If you have been hit by a car or motor vehicle which fled the scene after colliding into your vehicle, the first step you must take is to call 911 and file a police report describing the circumstances in detail of the accident. If you are unable to report the accident immediately, be sure to write the following information down and report it to the nearest self-collision centre:

- Where you coming from and where you were headed

- What street /intersection the accident occurred at?

- What lane and direction you were traveling in?

- Where the unidentified vehicle came from and where it hit your car? If you were not hit, how you were cut off?

- Note the color of the vehicle, details of the person driving the vehicle and license plate

- Note the time the accident occurred

- Note the names, addresses and telephone numbers of any and all witnesses present at the scene

- If you are required to go to a hospital as a result of your injuries, be sure to provide the hospital with as much information

- Report the above information at a self-collision center if police does not attend the scene of the accident - You may also be involved in an accident where an unidentified vehicle did not actually hit your vehicle but may have cut you off or caused you to be driven off the road causing you to collide into another vehicle or causing your vehicle to fall into a ditch. A situation as such will make you wonder whether you can sue the at-fault party even though you were not at fault and simultaneously you were unable to obtain the information of the vehicle that caused the accident. If you have been caught in such a situation, it is imperative that you take the above-noted steps forthwith.

- Well the good news is that at the time you purchase your insurance policy, there is a mandatory clause in every auto insurance policy in Ontario, which states that in the event you are involved in an accident caused by an unidentified / uninsured / underinsured vehicle and you were not at fault for the accident, you can, not only make a claim for accident benefits but a tort claim as well against your own insurance company. However, damages may be limited to a certain amount depending on the type of policy you purchased and whether you were cut off or whether someone hit your car and then fled the scene.

- For a detailed explanation of the benefits you can claim against your own insurer or the vehicle that you were traveling in (taxi /uber/ ride sharing vehicle/ friend or relative’s vehicle), known as Accident Benefits, click the link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- To know what heads of damages you can claim compensation under against the at-fault driver or vehicle, in this case your own insurer, click the link “I WAS NOT AT FAULT – WHAT ARE MY RIGHTS?”

HIT BY DRUNK DRIVER

- If you have been hit by a drunk driver, the first step you must take is to call 911 and file a police report describing the circumstances in detail of the accident. If you are unable to report the accident immediately, be sure to write the following information down:

- Where you coming from and where you were headed

- What street /intersection the accident occurred at?

- What lane and direction you were traveling in?

- Where the drunk driver came from and where it hit your car? If you were not hit, how you were cut off?

- Note the color of the vehicle, details of the person driving the vehicle and license plate

- Note the time the accident occurred

- Note the names, addresses and telephone numbers of any and all witnesses present at the scene

- If you are required to go to a hospital as a result of your injuries, be sure to provide the hospital with as much information

- Report the above information at a self-collision center if police does not attend the scene of the accident - In most cases, where a motor vehicle accident has been caused as a result of one of the driver’s being drunk, the auto insurance company of the drunk driver will refuse to defend the drunk driver and consequently, this drunk driver will not have any insurance that you can make a claim against.

- In Ontario, at the time you purchase your auto insurance policy, there is a clause included in every policy that protects you in such situations. The clause in your auto insurance policy posits, in the event you are involved in an accident caused by an unidentified / uninsured / underinsured vehicle (in this case, the defendant would be uninsured) and you were not at fault for the accident, you can, not only make a claim for accident benefits but a tort claim as well against your own insurance company. Therefore, the good news is that you will be protected.

- For a detailed explanation of the benefits you can claim against your own insurer or the vehicle that you were traveling in (taxi /uber/ ride sharing vehicle/ friend or relative’s vehicle), known as Accident Benefits, click the link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- To know what heads of damages you can claim compensation under against the at-fault driver or vehicle, in this case your own insurer, click the link “I WAS NOT AT FAULT – WHAT ARE MY RIGHTS?”

WHAT IS THE VALUE OF MY CLAIM AND WHEN WILL MY CLAIM SETTLE?

- Pursuant to the rules of the Law Society of Upper Canada, lawyers are not allowed to give a guarantee on what they consider in their opinion to be the value of your claim. It is perhaps safe to provide an estimated value of what the damages may be worth, provided your lawyer has been provided with truthful and accurate information with respect to your losses and injuries.

- There are several factors and contingencies that come into play in such scenarios. As noted above, in simple terms, there are two parts to a motor vehicle accident claim, the first part which is commenced forthwith subsequent to the accident, is called the Accident Benefits or AB claim, and the second part of the claim is called the tort claim, which you can only make if you are not at fault.

- With respect to your Accident Benefits claim, you must appreciate and understand that a claim for Accident Benefits does not mean that you will land an automatic settlement. If your AB insurer extends a reasonable offer to settle your claim, our firm will advise you as to whether we consider the settlement offer to be reasonable or not. At the end of the day, it is your decision as to whether you want to settle or not, provided there is a settlement offer on the table. At our firm, if we are of the opinion that the settlement is not reasonable, we will advise you in writing asking you to reconsider your decision or advising you to not settle on the premise of the injuries sustained.

- At the same time, there are certain insurance companies who very much take the position that they will not settle your Accident Benefits claim and would rather keep your claim open. It is imperative that you appreciate, that the Accident Benefits claim is a claim predominantly (in most situations, unless you have sustained catastrophic injuries or it is a case for wrongful death) for medical / rehabilitation benefits, income replacement benefits, attendant care benefits and non-earner benefits. Insurance companies are under no obligation to settle your accident benefits claim. Further, you cannot settle your Accident Benefits claim for 1 year from the date of the accident. Several factors such as your burn rate come into play and the kind of injuries sustained. Insurance companies tend to settle claims that they know will be costly to them in the long run.

- Moving further to the Tort aspect of the claim, this part of the claim is usually commenced after 1 year or so, it could even be earlier or much later. Every claim is unique and has its own merits. The simple reason for commencing a claim after 1 year or so is to gage /measure your losses and injuries sustained.

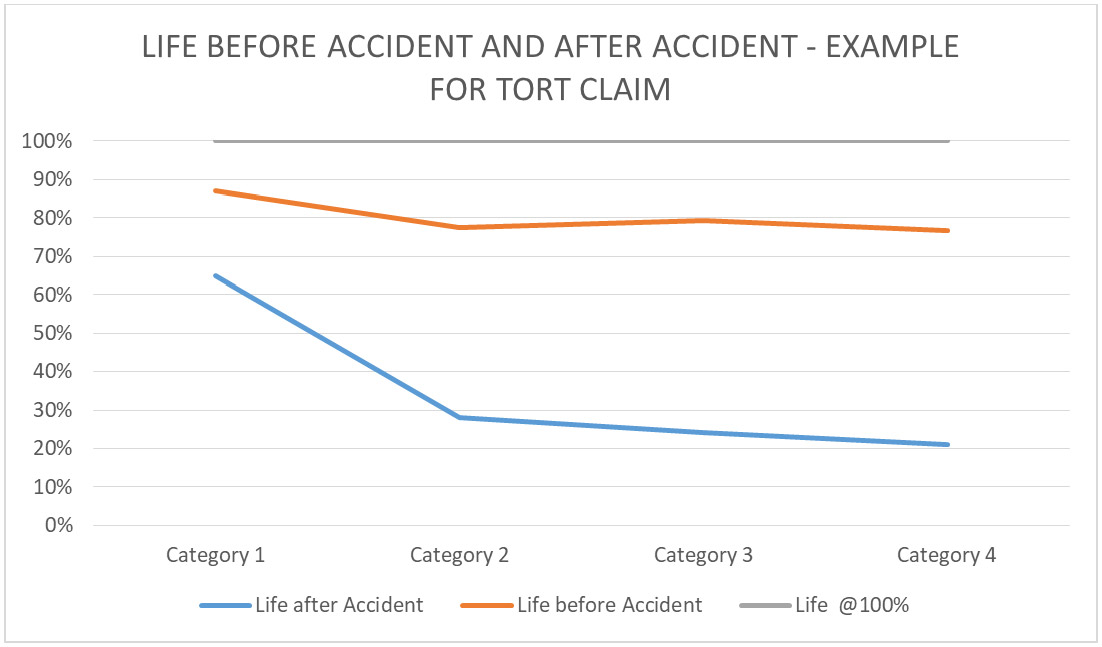

- See the graph below, which explains what your life may have been before the accident and what your life is now after the accident:

- Take a look at the orange bar in the above graph. Your life was the orange line prior to the accident, where you were pretty much at 90% of your life, where you could work properly and if not working, then contribute as a full-time home maker. At UL Lawyers, we very much appreciate and respect the fact that being a homemaker is a full time job. Prior to the accident, you would also volunteer, spend time with children, spend time gardening or you had certain hobbies you would spend time towards.

- However, since the accident, your life has been on a decline, which is evidenced by the blue line, in the graph above. You can see how since the accident, life has just hit a rock bottom. At our firm, we will not propose a settlement until your injuries have become permanent and there is no further possibility for recovery. Forcing your lawyer to settle your claim early will only hurt you and no one else. There is no point in attempting to settle your claim until we know what your final injuries are and we can only know after a year at the minimum. For example, you can sustain a fracture and later recover with no pain and barely take any time off work and in such a scenario, your damages would very much be limited.

- For Tort claims, the court procedure can be long, if the claim is commenced in the Superior Court of Justice under ordinary procedure. Sometimes, the tort claim can be settled at the adjuster level as well, however it depends on how reasonable the insurer is and what the prognosis is of your recovery. If the insurer is not interested in settling your claim at the adjuster level, then the court proceedings can take up to 1-2 years after commencing the claim. It also depends on how many vehicles are involved in the accident. If there are more than 2 vehicles involved, dates have to be coordinated amongst three to four different lawyers and subject to availability, it can take some time. At times, depending on how severe your injuries are, it can even take up to 4-5 years or even longer. In particular, for serious and catastrophic injuries, settling a claim can take up to 4-5 years or even longer. Just because you have sustained serious and/or catastrophic injuries, it does not mean that the insurance company for the at-fault will just cut you a cheque for a million dollars and wish you good luck; that does not happen. Insurance companies will fight tooth and nail to avoid paying you every dime and nickel.

- As you can see from the graph above, even the insurance company for the at-fault party will want to see what your level of recovery is, they will not just cut you a cheque. The insurance company will want to see whether you are a malingerer and if you are just trying to milk the system, your credibility is very much assessed. Further the insurer will see what efforts you have made to improve your life and get your life back on track. Have you consistently taken treatment to treat your injuries? Have you visited your family doctor regularly? Are you now able to return to part time work or whether you have at least tried returning to work? These are several factors that the insurer will look into before discussing settlement.

- We do not mean to discourage you from making a claim, however it is imperative that you appreciate that it can be a long and cumbersome process depending on your injuries sustained and losses incurred.

- Albeit, if your claim is worth less than $25,000 and we have commenced a tort claim for you in Small Claims court, then the legal proceedings should be resolved within the first year. Similarly, claims commenced under Rules 76 – Simplified Procedure, do not take that much time either and a resolution is visible.

- In Ontario, according to statistics, 97% claims settle and 3% go to trial.

DISPUTING DENIED ACCIDENT BENEFITS

- Prior to the legislative changes that were brought by the provincial government in Ontario on June 1, 2016, if your Accident Benefits insurer denied your claim for benefits (for example chiropractic treatment or income replacement benefits), you would be required to file an application with the Financial Services Commission of Ontario (FSCO), where a mediation would take place over telephone. If the mediation was successful, the disputes would resolve and the accident benefits file would remain open or the file would settle on a full and final basis. However, if the application for mediation failed, which means that the insurer and applicant were not able to see eye to eye and the insurer has refused to pay the benefit or fund treatment, then the applicant in such a scenario had two options, the first being, the right to sue your own insurer and the second to file an application for arbitration.

- The government in power at the time in an attempt to appease insurance companies while advising the public this was done to reduce auto insurance premiums, brought about specific legislative changes, which reduced the benefits to half (which can be seen above) and most importantly took away the right to sue your own insurance company, which also means that you are now barred from commencing a bad faith claim against your own insurance company. Consequently, they can treat you any way they feel is right, without the fear of having to pay punitive or aggravated damages.

- As per the new legislative changes brought on June 1, 2016, you are now required to file an application with the Licensing Appeal Tribunal (LAT) as applications to the Financial Services Commission of Ontario have been discontinued. At the time the changes were brought about, the government advised that this new system through LAT would expedite the process and would be a much more fair process. In fact, it is our experience that seeking a response from the tribunal is taking the same amount of time, it would take to secure a date for mediation with FSCO.

- Not only has the right been taken away to sue under the LAT, but you cannot claim legal costs. For example, if you are involved in an at-fault accident and have sustained serious injuries and in the insurer denies your treatment after sending you to their doctor of choice and you pay a lawyer to file an application for denying your benefits, if you succeed, you cannot seek these costs against the insurer that you paid your lawyer. Further, if the Adjudicator at the tribunal is of the opinion that the insurer withheld the benefits unreasonably, then the maximum special award payable to you is 50% value of the benefit that was denied. For example, if the insurer withheld your income replacement benefits unreasonably for 6 months and during this time you failed to make your mortgage payments in a timely fashion and as a result your home was foreclosed leaving you on the streets, well in such a case, for acting in bad faith, the insurer will have to pay 50% of the value of the Income Replacement Benefits that they denied. The additional 50% of benefits at that time will mean nothing to you when you have already lost your home and sad truth is that you are also barred from suing your own insurance company for bad faith.

- We very much encourage you to speak to your local MPP about this issue and raise your voice against the government profiting insurance companies with billions of dollars at your expense.

- To compare the benefits which were reduced by approximately 50% in attempt by insurance companies to reduce premiums by 15%, click the link “AT FAULT – WHAT ARE MY RIGHTS / ACCIDENT BENEFITS?”

- Another sad truth is, the premiums never came down by 15% but the benefits have been reduced by approximately 50% and there is no proper judicial authority in place any longer that can oversee or punish insurance companies for acting in bad faith.

Call us now at 905 744 8888 or 519 891 8888 or email us at info@ullaw.ca for more information of Car Accident Lawyer Mississauga and Car Accident Lawyer GTA or a free consultation.